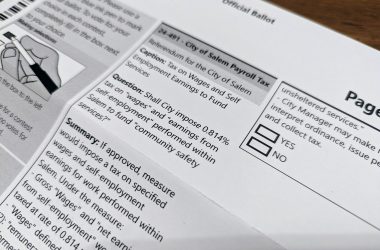

The Salem City Council narrowly approved a tax on worker paychecks on July 11, which aims to close a city budget deficit and sustain and expand emergency and homeless services.

Monday’s vote came after several hours of public testimony, the majority of it opposed to the tax. That meeting followed months of deliberations by councilors in budget meetings, and outreach with neighborhood associations that some councilors say yielded mixed feedback and more favorable opinions than reflected in the meeting.

Salem Reporter has been following the payroll tax for the past several months, and has previously reported on its major goals: Sustaining and expanding police and fire, and keeping the doors open on the city’s homeless services currently funded by one-time federal and state Covid grants.

The tax will bring in an estimated $27.9 million per year through a 0.814% tax on worker paychecks for all work done within Salem. That’s about $42 per month for a Salem worker earning the city’s average wage of $29.90 an hour.

People who make minimum wage are exempt, and retirement or pension income is not subject to the tax.

Ultimately, councilors voted to approve the tax in a 5-4 split.

Mayor Chris Hoy, Council President Virginia Stapleton, and Councilors Linda Nishioka, Trevor Phillips and Micki Varney voted to impose the tax starting in July 2024.

Councilors Julie Hoy (no relation to Chris Hoy), Deanna Gwyn, Vanessa Nordyke and Jose Gonzalez first voted to send the tax to voters during the next general election. When that motion failed, the group voted against imposing the tax.

The council’s decision will put the tax to a public vote no later than 2031, after seven years of tax collection. Oregon Business & Industry, the state’s largest business group, is seeking signatures to try to put the issue on the ballot this November through a referendum.

After Monday’s meeting, Salem Reporter sent each councilor a set of questions via email regarding the public comment process, their top priorities when making their decision and the impact of the tax.

Councilor responses below are edited for length and in some cases paraphrased. They are listed in order of ward.

Click each councilor to go directly to their responses.

Council President Virginia Stapleton

Councilor Deanna Gwyn (did not respond)

Mayor Chris Hoy – in favor

Please list your job or current source of income. To the best of your knowledge, would you be subject to the payroll tax? Approximately how much do you expect you’d pay per year?

“My job is serving as the Mayor of Salem. This is a full-time position that does not offer any salary or benefits whatsoever. Because of the hours required, a paying job is not an option for me. Currently, I rely solely on my retirement.

It is not clear to me how this is relevant. I make decisions based on what I believe is best for the city as a whole and certainly not how they would impact me personally. I would gladly pay the payroll tax if I were lucky enough to receive payroll income.”

The city encourages citizen participation. What would you say to a citizen who took time to testify against the payroll tax on why their time spent that night mattered?

“I have to consider the entire community when deciding on how to vote on an issue, not just those that support a particular narrative or position. I appreciate the perspective of every person who testified. I also appreciate the perspectives of those who testified at our budget committee meetings, our budget committee members, residents with whom I speak as well as that of the staff. All of that input is valuable, and matters.”

You ultimately did not change your vote between the May budget committee meeting and the city council meeting despite new feedback from the community. Why?

“Every vote I take is based on all of the information I have up to the time of the vote. Our tax system is broken leaving cities with the prospect of cutting services or imposing taxes to maintain or increase services. We are at the same staffing levels as we were in 2008-2009 in our fire department despite adding over 26,000 residents during that time. Violent crime is on the rise, fire department calls have increased significantly, response times have increased to unacceptable levels, and we have just started to make headway on the homelessness crisis.

Our community has demanded we deal with the homeless crisis, and they are very concerned about violent crime. This is the topic of conversation at every neighborhood meeting I attend. We are elected to use our judgment to make decisions in the best interest of the community. And that is exactly what I did. A failure to impose this tax would mean a complete decimation of city services. That is unacceptable to me and to our community. I wish the legislature would have come through and helped support their capital city. However, they did not.”

What is the primary reason you ultimately voted in favor of it?

See above.

What is the primary reason you opposed letting voters decide on a major tax increase?

“I have information about the state of the budget, demand for service and the urgency of the matter that the average voter does not have. I believe this tax is in the best interest of the community.

Passing a tax measure at the ballot box would require a costly campaign that would take a tremendous amount of time and money. Having just run the bond campaign, I believe the prospects of raising that amount of money and finding councilors willing to spend the time necessary to run a campaign would be virtually impossible.”

Many of those who testified said they could not afford an additional cost each month. Do you feel that the city services funded by the tax adequately support low-income families?

“I understand this will be a burden for some people. We tried to lessen that impact on minimum wage workers by exempting them from this tax.”

How does your vote represent the wants and needs of your constituents?

“People want a thriving and vibrant city. Because our tax system is broken, this was the only option available to achieve that goal. I wish that weren’t the case, but it is. It would have been easy to vote no on this, but our residents elected me to lead us into the future. This tax helps prepare the city for that future.”

Virginia Stapleton, Council President, Ward 1 – in favor

Please list your job or current source of income. To the best of your knowledge, would you be subject to the payroll tax? Approximately how much do you expect you’d pay per year?

“I am a fulltime mom which of course is unpaid work as well as a City Councilor. I average 30 hours a week of unpaid time for my constituents and the residents of Salem. My husband works fulltime and our family expects to pay around $900 a year for the Safe Salem payroll tax.”

The city encourages citizen participation. What would you say to a citizen who took time to testify against the payroll tax on why their time spent that night mattered?

“This is an interesting question because it only values those who are against the measure. Because of the bias in the question I’ll do my best to answer in a more general way. Civic participation is a very important part of our democracy. Every time someone reaches out to me via email, phone call or in person; every time someone signs up and provides public comment; every time someone attends a Neighborhood Association meeting or local civic group, those interactions help communicate to elected officials what’s important to our constituents and what the needs are in the community. My job is to take all the input and comments I receive and make the best decision I can representing my ward and the city as a whole. I must think about every aspect of an issue and the possible outcomes as well as plan for the future of the city. Even if I do not agree with a perspective or a desired outcome it doesn’t mean it wasn’t valuable to hear from the person.”

You ultimately did not change your vote between the May budget committee meeting and the city council meeting despite new feedback from the community. Why?

“I have tried to be very clear with where I believe the priorities are throughout this process. I know there are some that don’t agree with me, but I also know that many do agree and are thankful for my leadership on this issue. Although I understand and am sympathetic to people’s concerns, I haven’t heard anything that outweighs my concerns for the City’s ability to provide critical services to its residents. I remain open to new ideas on how to reach our goals and continue to listen for ways that I might be able to partner with others.”

What is the primary reason you ultimately voted in favor of it?

“The residents of Salem have repeatedly and in many ways asked for continued investment in City services with a priority given to emergency services and helping our unhoused population … As we saw in this legislative session, the State is not going to come to the rescue nor are they going to take up the issue of comprehensive tax reform. Our County Commissioners are not doing enough to help with mental health or drug treatment programs. Neighboring towns are allowing Salem to bear the burden of homelessness alone and are not stepping up and helping those in their own communities. We are on our own.

Salem is also unique in that it is the State Capitol and therefore the State owns a lot of property in town that they do not pay property taxes on. In fact, three of our top employers do not pay property tax. This is a huge burden to the City because many of these institutions frequently use our emergency services.

…To vote against this motion was to risk basic services our residents demand and the many wonderful quality of life programs our residents deserve and desire.”

What is the primary reason you opposed letting voters decide on a major tax increase?

“Many don’t know this, but the City cannot help run campaigns, they cannot pay for them or offer any other support other than information. It would be up to the nine of us on Council to do the heavy lift. We would need to raise anywhere between $30-100k (the more the better), design the campaign, run the education and outreach and in the end secure the vote. Most of us have fulltime jobs, family obligations and our continuing work on Council. … I am also concerned that we would have a campaign in opposition to the measure and most opposition efforts are very well funded making them hard to compete against. In the end, I knew that although it was the unpopular thing to do, it was the right one considering all the obstacles.

My work now is to ensure broad community outreach and crystal-clear transparency throughout the rule-making process and beyond. That communication and transparency needs to continue as we make the investments in our community a reality. I must prove to our residents that this new revenue is needed and that they will benefit from the work we’re doing on their behalf. When this DOES go to the voters, I will be able to stand proudly on the accomplishments we’ve achieved.”

Many of those who testified said they could not afford an additional cost each month. Do you feel that the city services funded by the tax adequately support low-income families?

“Helping support low-income families is top of mind for the Council and we do this in several ways. We’ve included an exemption for all minimum wage workers and because this is a payroll tax it protects seniors who are often living on social security alone. We’re also moving to a better implementation system for the City’s operations fee, with this upgrade we will be able to add in more equity to the system, further helping those in financial need.”

Stapleton said that councilors are working to increase affordable housing in Salem, and the city’s Transportation System Plan will increase choice and accessibility. She said support of Cherriots free ride program for youth and in-progress housing projects are also examples.

“If we did not continue to invest in our community with the Safe Salem payroll tax the following support services would be lost,” she said, including access to programs and support at the Salem Public Library, meals and activities at Center 50+ and its Wellness on Wheels van, parks and youth education and training programs.

How does your vote represent the wants and needs of your constituents?

“Our residents are wanting and demanding that we make investments in our city, both in our core services and in quality of life services. …My constituents are not asking me to cut services, they are asking for more services! More libraries, better parks, more crosswalks and complete sidewalks in their neighborhoods. They want more street trees and safer transportation choices. They want Community Policing and quick response times for all emergency services.”

Without new revenue options, Stapleton said Center 50+ and the west Salem branch library would close. Youth services would be cut, library hours reduced and park maintenance reduced to mowing only. Neighborhood services, planning, permits and courts would also see impactful cuts. Police and fire would see cuts and programs for unsheltered Salemites would end.

“To me the choice was clear, make the investment but don’t stop looking for better options. Continue to pursue funding from our State Legislators and more services and support from our Counties and surrounding cities and towns. Support City services and find creative ways to ease the financial burden for families and individuals struggling to make ends meet.

…No one person can do this work, it will take all of us doing our part. “

Linda Nishioka, Ward 2 – in favor

Please list your job or current source of income. To the best of your knowledge, would you be subject to the payroll tax? Approximately how much do you expect you’d pay per year?

“My current job is being a city councilor. I voluntarily spend 30 to 40 hours a week in this position. As you know, it is a non-paid position, but if I had a salary, I would support the collective community with any tax enacted for the needed revenue.

My current source of income is from commercial properties, and yes, I will be subject to the payroll tax. I would pay approximately $1200 – $1500 annually based on current income estimates.”

The city encourages citizen participation. What would you say to a citizen who took the time to testify against the payroll tax on why their time spent that night mattered?

“Thank you for taking the time to speak before the council and sharing your opinion.”

You ultimately did not change your vote between the May budget committee meeting and the city council meeting despite new feedback from the community. Why? What is the primary reason you ultimately voted in favor of it?

“The City of Salem has been cutting since the 2000s. There is nothing to cut without extreme consequences. I would hate to see this happen. I refuse to see this happen. I want to avoid seeing the previously unsheltered back on the sidewalks and parks because we could not support the facilities our citizens asked us to build. Assisting the homeless and unsheltered has been a top priority of Salemites. I want to continue the services we have in place for all of our citizens.

We must invest in our city to allow citizens, businesses, and industries to have the services they need, want, and deserve. I want Salem to survive and thrive.

Incidentally, I heard from many citizens who chose not to give public testimony at the city council meeting that voiced strong support for the employee payroll tax.”

What is the primary reason you opposed letting voters decide on a major tax increase?

“American democracy is founded on the principle of representative government, where elected officials, such as members of Congress, state legislatures, and city councils, are chosen by the people to make decisions for the benefit of their constituents and community. One of their key responsibilities is deciding on taxes, as they can create, modify, and implement tax laws that align with the interests and needs of the community.

My elected officials decided on most of the taxes I pay and have paid.”

Many of those who testified said they could not afford an additional cost each month. Do you feel that the city services funded by the tax adequately support low-income families?

“Another way to consider this statement and question is what would happen to low-income or middle-income earners without this tax revenue. Many services and resources they currently utilize may not be adequately funded without additional revenue. I recognize the potential hardship some may face, and this council asked for mechanisms to help support low-income families, one of which was for minimum wage earners be exempt from the tax. Again, the larger question is, what would these families lose without new revenue?”

How does your vote represent the wants and needs of your constituents?

“I have heard from many, and most of my constituents understand the need for revenue and ask that the council act. While not all believe that the employee payroll tax is preferred, they support a tax that would generate revenue to care for our city and its citizens.”

Trevor Phillips, Ward 3 – in favor

Phillips sent the below response addressing the same set of questions listed above.

“My driving goal is to create a safe and healthy Salem. As I am sure you know, if the city council would not have increased revenue, we would have had to make catastrophic and unacceptable cuts to these services. There is no doubt in my mind that the disastrous cost to the lives and livelihood of Salem residents would far exceed the cost of [a 0.814%] payroll tax.

As the elected representative for Ward 3, I believe I represented my constituents’ best interests when I supported raising revenues rather than drastically slashing these vital services. The testimony you heard at the council hearing, more than half of which were from people who do not live in Salem, was not representative of my ward. I would encourage you to reach out more widely to actual Salem residents rather than report only on those who testified on Monday to get a more diverse range of perspectives. I would be happy to put you in touch with Ward 3 residents that have a different view.”

Phillips linked a speech he made during the meeting to explain his vote, below:

“Of note, I attended Faye Wright and Morningside neighborhood association meetings this week after our votes on Monday night. Precisely one person expressed disappointment in my vote, and more than 6 others have publicly praised my vote. Many of these neighborhood association board members are volunteers who have lived in South Salem for years and or decades. They understand the broken nature of our state property tax system and the need to raise revenue.

For a sense of perspective, I literally got twice as many complaints about dangerous, disruptive and illegal fireworks (2 people) this week than I got about the payroll tax (1 person) at these neighborhood meetings.

Finally, I am somewhat uncomfortable sharing aspects of my personal finances with the broader public, but I also think it’s important people understand. Yes, I am subject to the payroll tax. I estimate that I will pay between 1200 and 1600 dollars per year depending on how many shifts I work as an Emergency Room doctor. For the past 15 years, I have only worked in Salem. I have no plans to work anywhere else. I like living and working here. Salem is my home.”

Deanna Gwyn, Ward 4 – opposed

Gwyn did not respond to Salem Reporter’s emailed questions in time for publication.

Jose Gonzalez, Ward 5 – opposed

Note: Gonzalez did not respond to Salem Reporter’s emailed questions in time for initial publication, this section has been updated with responses submitted Tuesday afternoon.

Please list your job or current source of income. To the best of your knowledge, would you be subject to the payroll tax? Approximately how much do you expect you’d pay per year?

Realtor, yes and it will vary just like my income.

The city encourages citizen participation. What would you say to a citizen who took time to testify against the payroll tax on why their time spent that night mattered?

It mattered.

You ultimately did not change your vote between the May budget committee meeting and the city council meeting despite new feedback from the community. Why?

My vote was to send it to the voters.

What is the primary reason you ultimately voted against it?

I never forget we are here to represent the people but not make every decision for them. This one was too important to not give everyone a chance to have their say.

What is the primary reason you supported letting voters decide on a major tax increase?

This is one of those issues most of them will personally feel.

Many of those who testified said they could not afford an additional cost each month. Do you feel that the city services funded by the tax adequately support low-income families?

The city services that would be funded by this tax are not only for low income families, so only time will tell if they will truly feel the support.

How does your vote represent the wants and needs of your constituents?

Based on all the conversations I’ve had before and after the decision, I am in line with 99% of them.

Julie Hoy, Ward 6 – opposed

Note: Below are direct quotes from Hoy, which included ellipses.

Please list your job or current source of income. To the best of your knowledge, would you be subject to the payroll tax? Approximately how much do you expect you’d pay per year?

“I own Geppetto’s Italian Restaurant. Our business is in Marion County… not the City of Salem. That said… apparently… I will have to track any time spent doing business in Salem. As I see it… the city is not prepared to handle the many nuances around this can of worms.”

The city encourages citizen participation. What would you say to a citizen who took time to testify against the payroll tax on why their time spent that night mattered?

“I heard them and yes they matter. I applaud those who wrote in… showed up and spoke up. Impressive… given the short amount of time granted for public awareness.”

You ultimately did not change your vote between the May budget committee meeting and the city council meeting despite new feedback from the community. Why?

“Because I really believe the hard work hasn’t been done. The hard work would be shifting priorities in spending to meet current needs. That’s where the hard decisions would have to be made.”

What is the primary reason you ultimately voted against it?

“Because… at a minimum… matters such as this should be put to voters for consideration and input.”

What is the primary reason you supported letting voters decide on a major tax increase?

“Because it was the right thing to do.”

Many of those who testified said they could not afford an additional cost each month. Do you feel that the city services funded by the tax adequately support low-income families?

“I don’t know everything there is to know on this topic. My first reaction is no… because… simply put… this Ordinance which Council passed has not been clearly defined.

We are to be good stewards of tax payers contributions. Reaching in without permission to take is easy and wrong.”

How does your vote represent the wants and needs of your constituents?

“I haven’t spoken to all of them… but when I think about what I would want… I would hope my representatives are listening and standing up for my rights as a citizen.”

Vanessa Nordyke, Ward 7 – opposed

Please list your job or current source of income. To the best of your knowledge, would you be subject to the payroll tax? Approximately how much do you expect you’d pay per year?

“Executive Director of CASA of Marion County, a 501(c)(3) nonprofit dedicated to advocating for children in foster care. Yes, I’m subject to the tax. Although my office is in Keizer, I do perform some work in Salem. I don’t have an estimate at this time.”

The city encourages citizen participation. What would you say to a citizen who took time to testify against the payroll tax on why their time spent that night mattered?

“To the citizens who took time to testify against a payroll tax, I heard you loud and clear. The mother who talked about the impact that this tax would have on her ability to take care of three children and pay for health care brought me close to tears. My own mother was a single mom for a number of years, so that hit close to home.”

You ultimately did not change your vote between the May budget committee meeting and the city council meeting despite new feedback from the community. Why?

“I listened to every piece of testimony throughout the process. I spoke about the payroll tax with my neighborhood associations, local business owners and other community members. Throughout the conversations, I listened for reasons that would change my mind, and nothing I heard changed my vote.”

What is the primary reason you ultimately voted against it?

“No voter input. The people expect to vote on payroll taxes. Passing the payroll tax without taking it to the voters was a huge breach of trust. Based on the fact that we took three bond measures to a vote in recent history, and we were on the brink of taking this payroll tax to the voters in 2020, the voters reasonably expected to be asked for their vote on this tax.”

What is the primary reason you supported letting voters decide on a major tax increase?

“See above.”

Many of those who testified said they could not afford an additional cost each month. Do you feel that the city services funded by the tax adequately support low-income families?

“No, absolutely not. This tax disproportionately hurts low income families, by charging the same tax rate regardless of income. I urged exception of minimum wage workers, but people making just above minimum wage will be hit the hardest. I used to live paycheck to paycheck, so I know what it’s like when every dollar counts.”

How does your vote represent the wants and needs of your constituents?

“My constituents expect accountability and transparency, something that the city needs to do much better at. So I would fully expect them to expect me to take a payroll tax to the vote.”

Nordyke said she sought $300,000 to support the county’s mobile crisis unit, which will send mental health providers to calls rather than police. She sought to fund a Salem-specific unit, which didn’t make the final version of the tax.

“My constituents want me to follow evidence-based policies that actually reduce homelessness, instead of throwing money at the problem. This payroll tax throws a lot of money at police-led homeless outreach, which does not reduce homelessness. Police officers are not service providers, housing navigators, drug and alcohol treatment specialists, crisis workers, or mental health specialists. Paying a police officer to tell a homeless person to go to a shelter doesn’t do any good if all the shelters are full.

The payroll tax does not raise a dime for new homeless shelters despite the fact that every Salem shelter is regularly full and/or has a wait list. Funding the short list of existing shelters is just not good enough. My constituents want to see people off the streets and living in safe and stable housing. They want to see able-bodied adults working and living self-sufficiently. Unfortunately, this tax prioritizes policing homelessness over ending homelessness. Not cost-effective. Salem deserves better.”

Micki Varney, Ward 8 – in favor

Please list your job or current source of income. To the best of your knowledge, would you be subject to the payroll tax? Approximately how much do you expect you’d pay per year?

“I currently work for Oregon Department of Fish and Wildlife. I would pay approximately $683.00 per year.”

The city encourages citizen participation. What would you say to a citizen who took time to testify against the payroll tax on why their time spent that night mattered?

“I would thank them for coming to the meeting and encourage them to continue to be engaged and motivated to keep current with what is going on in their city. I would reiterate how much I appreciate them voicing their opinion and how frustrating it is when I respond to an email from a constituent, and although I ask for suggestions or ideas of what they want or how they would approach solving a problem, often I don’t hear anything back. I would also send them the link to the calendar so they would know how to access agendas and minutes from Council meetings as well as give them the address to sign up for the newsletter.”

You ultimately did not change your vote between the May budget committee meeting and the city council meeting despite new feedback from the community. Why?

“Salem’s looming budget deficit hasn’t gotten any better between May and July 10. Providing the essential city services residents rely on and the parks, activities and appeal that makes them want to call Salem home is very important to me. Ensuring public safety is paramount. The reduction framework presented at the May 15 work session which identified cuts to programs to get to the $19.4 million deficit target will decimate services.”

What is the primary reason you ultimately voted in favor of it?

“We needed a stopgap measure to temporarily slow the momentum of our declining fund balance and we needed a means to maintain current services while we determine alternative revenue sources. I don’t believe the Payroll Tax is the appropriate tool for the long term but it would have temporarily bridged the gap.”

What is the primary reason you opposed letting voters decide on a major tax increase?

“Expediency and urgency—in short, the gravity of the situation and the additional delay in that would have occurred had we waited 4 more months. With a delay, we would have been forced to start making cuts to programs. Slashing $13.9 million of community services which support park maintenance, our libraries, Center 50+, city-wide recreation programs would be devastating. Reductions to the permitting and planning department would further slow development and building of housing inventory. Trimming an additional $2 million from police and fire would increase risks to health, life and property. We’ve observed, from the ongoing Covid recovery period, how long it takes to get people hired and get the wheels turning again. Reinstating programs down the road at some point will be slow and will be more expensive as well.”

Many of those who testified said they could not afford an additional cost each month. Do you feel that the city services funded by the tax adequately support low-income families?

“Lower income families need fire and police protection as much as all the other Salem residents. Everyone wants to feel safe in their city.”

How does your vote represent the wants and needs of your constituents?

“I do not think West Salem residents would be supportive of closing one of our fire stations, our branch library and one or more of our parks. Wallace Marine and Orchard Heights are very popular parks in West Salem. The loss of recreation services like softball and kickball and support for amenities like the community garden would be a blow to the local community.”

Contact reporter Abbey McDonald: [email protected] or 503-704-0355.

SUPPORT OUR WORK – We depend on subscribers for resources to report on Salem with care and depth, fairness and accuracy. Subscribe today to get our daily newsletters and more. Click I want to subscribe!

Abbey McDonald joined the Salem Reporter in 2022. She previously worked as the business reporter at The Astorian, where she covered labor issues, health care and social services. A University of Oregon grad, she has also reported for the Malheur Enterprise, The News-Review and Willamette Week.