Oregon’s largest business group has filed a petition to refer a new city wage tax to Salem voters.

Oregon Business & Industry, a Salem-based advocacy group which represents 1,600 businesses across Oregon, filed a petition with the city recorder seeking a referendum on the payroll tax which the Salem City Council narrowly approved last week.

Salem voters would get to vote on the tax on the Nov. 7, 2023, ballot if petitioners gather enough signatures by Aug. 9, according to the petition.

The petition was filed and accepted on Friday, said Preston Mann, political affairs director for the business group.

It is the only petition the city has received as of Monday afternoon, according to city spokeswoman Courtney Knox Busch.

Mann’s petition will require 3,986 qualified signatures, 10% of the votes cast for in the city’s last mayoral election in 2022, according to city code. That would be about 3.5% of all registered voters in the city.

The group is seeking 6,000 signatures to account for possible errors, according to a press release from Mann.

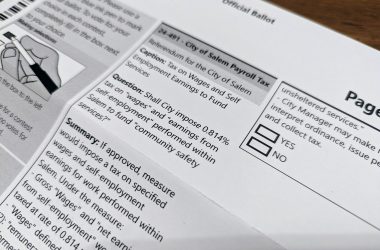

copy-of-petitionAfter a lengthy meeting on Monday, July 10, councilors voted 5-4 to tax the paychecks of people working in Salem, whether they live in the city or not, starting in July 2024. They voted after hearing over two hours of public testimony, nearly all opposed to the tax. Those who voted in favor said they have heard support for the tax through neighborhood association meetings and outreach.

The tax rate is 0.814% of all wages earned within the city of Salem. Minimum wage earners would be exempt.

The money would cost the average worker about $500 per year and go toward closing a city budget deficit.

The tax is expected to bring in $27.9 million per year. The Salem Police Department would receive the largest share of money raised, about $10.5 million per year, followed by homeless services with about $7.9 million and $6.5 million for the city’s fire department.

Money would be used to maintain existing police and firefighter positions and add new ones. It is also intended to keep homeless sheltering services open after the federal and state money currently paying for them runs out next year.

If petitioners submit signatures after the Aug. 9 deadline, the measure could instead appear on the May 2024 ballot.

READ IT: Petition to refer the payroll tax to Salem voters

Under the tax ordinance the council passed, Salem voters would instead get a vote no later than July 1, 2031, after seven years of tax collection.

Councilors who voted in favor of the tax said that it is essential to maintaining police, fire and homeless services to keep Salemites safe, addresses the needs of a growing population and prevents cuts to citywide services like libraries and public works.

Many Salem businesses and workers spoke or submitted testimony against the tax for a variety of reasons. Some raised concerns about affordability, while others objected to the city taxing people who don’t live in Salem to pay for city services.

“We have no problem with Salem or any other city asking voters to support levies for important local services,” said Angela Wilhelms, OBI’s president and CEO in a statement. “However, this proposal is vague, the tax is high, the administrative burden is significant, and there is little assurance as to how funds will be spent. At a minimum the community deserves a chance to vote.”

In late June, Oregon Business & Industry said they opposed the tax entirely.

“We’ve gone from a state with, arguably, a lower tax environment to a state with a significantly high tax environment. That hurts our ability to compete, it disincentivizes the things we want more of,” Scott Bruun, the group’s vice president for government affairs, told Salem Reporter.

Correction: This article was updated to reflect that the number of signatures needed is 10% of people who voted in Salem’s last mayoral election. A previous version said it was 10% of people who voted for Mayor Chris Hoy. Salem Reporter apologizes for the error.

Contact reporter Abbey McDonald: [email protected] or 503-704-0355.

SUPPORT OUR WORK – We depend on subscribers for resources to report on Salem with care and depth, fairness and accuracy. Subscribe today to get our daily newsletters and more. Click I want to subscribe!

Abbey McDonald joined the Salem Reporter in 2022. She previously worked as the business reporter at The Astorian, where she covered labor issues, health care and social services. A University of Oregon grad, she has also reported for the Malheur Enterprise, The News-Review and Willamette Week.