Salem legislators think they have a better chance during the 2024 Legislature to get state money paid in lieu of property taxes to help close a city budget deficit. Mayor Chris Hoy cautioned any such payment won’t fix the city’s budget issues.

Tag: payroll tax

Readers share what they intended with their votes on Salem’s payroll tax

Salem residents decisively rejected a payroll tax Tuesday, with 82% of those who cast ballots voting no. About 20 readers explained their votes to Salem Reporter, with many who rejected the tax saying they want a less complicated or more equitable way for the city to close its budget gap.

Salem City Council talks lessons learned from payroll tax

82% of Salem voters rejected the city’s payroll tax Tuesday night. Salem city councilors address two questions: What is the message from Salem citizens you see in the results? And, how will you act on that understanding?

82% of Salem voters reject city payroll tax

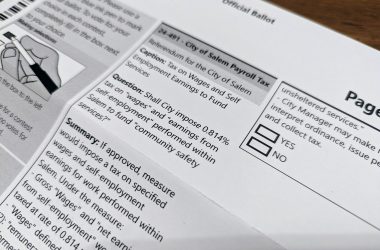

Salem voters have decisively rejected a payroll tax that would have taken 0.814% from paychecks citywide to fund city services, with 30,403 votes counted as of 8 p.m. Tuesday night.

ELECTION RESULTS: Salem payroll tax, Marion County fire levy

Results of the vote on Salem’s payroll tax and the Marion County Fire District #1 levy will be updated her shortly after 8 p.m. Tuesday.

How to make your vote on the Salem payroll tax count

Election day is Nov. 7, and with less than a week to go, most registered voters in Salem have not cast their ballots. Here’s a guide to election deadlines, dropbox locations and what’s in the voter’s pamphlet.

Cuts discussions continue at Salem City Hall

During a work session Wednesday, the Salem City Council didn’t seem to favor “extreme” cuts scenarios and considered reductions hitting multiple departments. The discussion came less than two weeks before voters will decide whether to implement a payroll tax to fund city services.

Salem City Council to discuss alternative cuts

The Salem City Council meets Wednesday to discuss ways to address its budget crisis if the payroll tax fails in November. Among the hypothetical scenarios is closing the library to retain police and fire, or to keep shelters open. They’ll also hear the feasibility of cutting vacancies and adding furlough days.

Your questions about Salem’s proposed payroll tax and budget challenges, answered

Dozens of people posed questions about Salem’s proposed wage tax at Salem Reporter’s Town Hall. As ballots go out, we’re answering as many as we can.

More than 100,000 Salem voters now have chance for say on proposed pay tax

County clerks in Marion and Polk counties have mailed out ballots that include a measure to decide the fate of Salem’s city payroll tax. Election Day is Nov. 7.