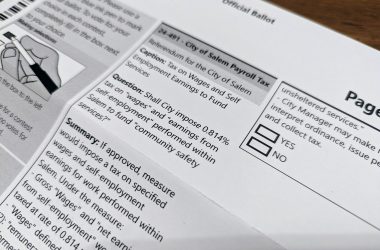

The Salem City Council voted 5-4 on Monday to impose an unpopular tax on workers’ wages for work done within city limits.

The payroll tax asks the average Salem wage earner to pay about $500 a year toward maintaining police officers, firefighters, homeless shelters, and adding more police and fire employees.

With over two hours of testimony at the council meeting Monday from around 50 people, nearly all were in opposition to the tax.

Councilors also received over 130 comments in opposition and 14 in support of the tax. Below is a small sampling of the written testimony.

Opposed

Too expensive

My issue also stems from the proposed amount–to my understanding, a 0.814% increase. While I recognize this is simply the mathematical reality of what it will take to close the gap, the amount feels prohibitive given the current economic realities faced by Salem residents due to inflation.

James Owens, Salem resident

During these times of high inflation we are already taking a massive hit in our wallets. We are not getting raises to offset the inflation and anyone who has gotten a raise it has not been nearly enough to offset the damage done by inflation.

Chad Kernutt, Oregon Department of Corrections employee

If you pass this payroll tax you would literally be taking money from the hardest working of families in our community at the same time that inflation and a poor economy are squeezing everyone financially

Adam Reed

While the tax might seem like only $8 for every $1000 earned – that is removing 2 gallons of milk a week from a family whose head of household brings home $4000 a month. It is 1 and 1/2 tanks of gas, a week of electricity- 3 days of heat in the winter. Where is this family to replace this?

Charlotte Eugenio

Send it to voters

Voters need to be a part of the solution in deciding how they want to see the City Council address its budget gaps. The fact that this proposed payroll tax will affect unrepresented employees across the city is very troubling. Non-citizens of Salem have no representation or recourse to the implementation of this tax.

Tony Schacher, general manager of Salem Electric

Seek alternative funding

I don’t think it is right to penalize people just for having a job. Just for getting a paycheck. I believe your counsel needs to go back and re-look at the city budget and maybe raise the business taxes for some of these corporate companies who are making millions of dollars a year

Cherita Wilson, a licensed realtor who sells real estate in the city of Salem

There are far too many moving parts to this tax and to be honest Salem City Council will continue to raise the payroll tax each year as they have continued to raise utilities, property taxes and garbage services rates over the last 7 plus years. The need for more police, fire and overall emergency service is great for the City of Salem. So, may I suggest that the Salem City Council members consider a sales tax instead.

Erin Baker

I’m not necessarily opposed to more taxes, because I realize that we have to pay taxes in order to support city services, but all these city taxes should be on our property tax bill, so we can discuss them and vote on them. After all we do live in a “democracy”, don’t we?

Frank Schiedler, Salem resident

Work within the budget

We ALL must live within our means. Just because the City of Salem has made poor budget decisions, it is unacceptable to reduce the finances of those that are responsible enough to have a budget and live within it.

Cynthia Mulheron Klein

Don’t live in the city, don’t have a say

I own AG Sadowski Company located at 1605 Liberty Street SE here in Salem. I oppose this new tax. Because the people who will be force to pay this tax are not being allowed to vote on this tax prior to its implementation, the tax is unconstitutional. In addition, it is an unwanted tax, not only unwanted by myself, but also all employees of my company.

Derek Sadowski, president of A.G. Sadowski Company

I work in Salem, but don’t live in Salem. Therefore, I didn’t vote for any of the current council, won’t be voting for the next round, and won’t be eligible to vote in 2031 should this be sent out to voters. I also have no say in how the money is spent. In that case, it seems wrong that you can decide to help yourself to a chunk of my paycheck. […] . I’m sure we all appreciate help in emergency situations, and it would be great to see more routine traffic policing done in order to create safer roads that produce fewer emergencies, but the bulk of the proposed spending undoubtedly provides greater benefit to the residents.

Rebekah Bonnesen

I find a very sad irony in the fact that such a tax is being considered so close to Independence Day. The phrase “no taxation without representation” comes to mind as I am a state worker who lives outside of city limits and do not have the ability to hold any member of the council accountable through elections—as our government was designed.

Jessica Snook, who lives just outside of Salem city limits closest to ward 5

Disincentivizes business growth

Employers are struggling to find good workers for their small businesses and now you want to start taxing the employees that they work so hard to hire. You are going to see our workforce disappear in Salem. Those who have the financial resources will survive but the gap between the wealthy and the poor will grow wider

Dan Farrington, Salem resident and former candidate for Oregon House District 20

The City of Salem should be trying to attract businesses and improve the city so that people want to work in Salem, not provide another reason to not work in Salem. Many people enjoy living outside the city and commuting in for employment. Instead, this proposed payroll tax would be a real incentive not to work in Salem. With high fuel costs you would be encouraging people not to drive to Salem for employment and rather find a job elsewhere, in many cases in a town closer to their home.

Heidi Hand

You are driving more self-employed people out of business and out of this State. Find the Funding somewhere else.

Cheryl Rodriguez, licensed broker in the Oregon Premiere Property Group

I am 25% owner of a high-precision aerospace manufacturing shop located on 2265 Judson Street SE. The commercial aviation industry was hard hit by Covid era travel bans and lockdowns.[…] Salem small businesses are not yet recovered from Covid. This is not the right time to add an additional Payroll Tax to Salem workers.

Dennis Kalnoky, Vice President of Accounting for Denezol Tool Co.

Disagree with homeless services

We know the legislature just approved record amounts to address homelessness and drug issues this session, and you need to recalculate what you expect from those of us in the general working class for whom this larger bite will ultimately have larger reverberations for businesses across Salem when we don’t use their services and cut our expenses to the bone to adjust for this increase

Jennifer Valentine, Salem resident

Other frustrations

I work with approximately 40 fellow employees at a Salem business. I brought the new proposal for a city of Salem payroll tax up at our monthly All Staff meeting. It was unanimous that all attendees were adamantly opposed to this additional tax. It was considered sheer lunacy that the City of Salem would consider doing this to the hard working VOTERS of Salem.

Lawrence Smith

This is a ridiculous idea. Just because you people clearly can’t budget your money doesn’t mean the rest of us that work in Salem should have to pay more!! We already pay way to much in taxes! Figure it out!

Zach Dillingham

This seems like nothing more than an ill-conceived money grab. Thousands of State Workers would now have to fund a poorly balanced budget and would be forced to fund programs they did not elect to put in place

Nikolas Ruiz Anderson, legislative aide for House District 3, Grants Pass

Support for the tax

Great work is being done to support homeless people through the Navigation Center and through the Micro shelter sites around the city. It is imperative that we build on these efforts and add to them. Additional mental health services are desperately needed, and we need City, State and Federal support and funding to address the shortfall.

Anne Sellers, a Salem resident and employee

In this instance, I believe the cost—both the political cost and the cost to the taxpayers—is far outweighed by the benefit. Cutting funds to emergency services and homelessness programs will cause Salem to significantly regress in terms of safety and livability. For Salem to truly become a city of peace we need more creative services, not less.

Cory Folkert

The tax will help Salem move towards becoming a safer, healthier, and livable community for all. […] if the tax does not pass, funding to the homeless navigation center and C@P’s micro-shelters would likely be the first cuts

DJ Vincent, founding pastor of Church at the Park

We’re not getting the help we need from the state and federal governments on homelessness, so we must take action ourselves. The payroll tax is an excellent way to do this because it taxes Salem workers who use city amenities and services, but aren’t contributing to the city’s coffers because they don’t live in the city.

Laura Buhl

Contact reporter Natalie Sharp: [email protected] or 503-522-6493.

SUPPORT OUR WORK – We depend on subscribers for resources to report on Salem with care and depth, fairness and accuracy. Subscribe today to get our daily newsletters and more. Click I want to subscribe!

Natalie Sharp is an Oregon State University student working as a reporter for Salem Reporter in summer 2023. She is part of the Snowden internship program at the University of Oregon's School of Communication and Journalism.