Update:

During its Monday, June 12, meeting, the Salem City Council advanced its 2023-24 budget, and set a date to hold a public hearing on a proposed payroll tax.

Councilors unanimously approved the citywide fee schedule, which included an increase to the city operations fee paid on monthly utility bills.

Rates will go up starting July 1, 2023. The fee will increase by $5.50 per month for residential homes, $4.40 per month for multi-family units and $26.51 for industrial, institutional and commercial properties. In January, there will be a second 6.25% increase for inflation.

The group also advanced the $754 million 2023-24 budget, which will go to an adoption vote on June 26.

Mayor Chris Hoy and Councilors Virginia Stapleton, Linda Nishioka, Trevor Phillips, Jose Gonzalez, Vanessa Nordyke and Micki Varney in favor of moving the budget forward.

Councilors Deanna Gwyn and Julie Hoy were opposed, saying that the city needed to make more cuts. Gwyn pointed to spending on homeless services, and Hoy asked about spending at the Salem Public Library.

City Manager Keith Stahley said that he explored scenarios to make reductions, but that city services are already understaffed and that the city faces a revenue rather than spending issue. Councilors who voted in favor said that homeless services and library funding are essential to the community, and save costs with long-term impact.

The council scheduled a public hearing on the proposed payroll tax for Monday, July 10.

Councilors either approved or advanced all other items on the evening’s agenda.

Original story:

The Salem City Council meets Monday, June 12, to consider steps to improve city revenue options for the next year, including approving its budget for the next year, increasing the monthly operations fee on utility bills and information about a proposed payroll tax to fund police and firefighters.

Also on the agenda are a grant to a local fruit processor and a home purchase to reduce flooding in a Salem neighborhood.

READ IT: AGENDA

How to participate

The council meets Monday, May 22, at 6 p.m. in-person at the city council chambers, 555 Liberty St. S.E. room 220, with the meeting also available to watch online. The meeting will be livestreamed on Capital Community Media’s YouTube channel, with translation to Spanish and American Sign Language available. Anyone may attend the meeting to listen or comment.

The public comment portion of the meeting takes place after opening exercises, such as roll call and the Pledge of Allegiance, and residents are invited to comment on any topic, whether it appears on the agenda or not. If a public comment does not relate to an agenda item, it may be saved for the end of the meeting.

To comment remotely, sign up on the city website between 8 a.m. and 2 p.m. on Monday.

For written comments, email [email protected] before 5 p.m. on Monday, or on paper to the city recorder’s office at the Civic Center, 555 Liberty St. S.E., Room 225. Include a statement indicating the comment is for the public record.

Public hearing on proposed 2024 budget, fee schedule adoption

Monday’s meeting includes a public hearing on the city’s proposed $753 million spending budget for the next year, followed by a council vote on approving it.

Because city spending is outpacing revenue, the proposed budget includes part one of the city’s plan to balance its budget: a 60% increase to the operations fee which shows up on resident’s utility bills. Part two of the plan is a payroll tax, which is not being voted on during Monday’s meeting.

If approved, the operations fee would add $5.50 per month to residential homes, $4.40 per month for multi-family units and $26.51 for industrial, institutional and commercial properties. In January, there would be a second 6.25% increase for inflation.

The city already increased the fee rate in January 2022 and again last January.

The increased funds would go to add park rangers, code enforcement, downtown security and Salem Outreach and Livability Services team, which works with Salem’s homeless community to make service referrals and do sanitation work.

After the approval vote, the council will vote on whether to adopt the budget on June 26, according to a report from Josh Eggleston, chief financial officer.

In a separate vote, councilors will consider adopting the annual fees and charges for the city contracts, licenses, inspections and permits. Fees typically increase along with the market, according to a staff report from Eggleston. Along with the city operations fee increase, several other services have proposed inflation-based increases.

If approved, fees for lien searches would go up between $5 and $9. Daily parking permit fees at Liberty, Chemeketa and Marion parkades would go up $2, and the city would add new fees for ground transportation and advertising at the Salem Municipal Airport.

The city’s budget committee recommended the budget to the City Council on May 10. The council may amend the budget, but cannot increase property tax levies or increase expenditures beyond 10% per fund.

At the meeting, any person may provide testimony for or against content in the recommended budget.

The city will also hold a hearing on whether to accept $2,374,380 in state revenue sharing funds, which come from state liquor revenue. The budget committee recommends that, like in past years, the funding go toward police patrol, according to a staff report from Eggleston.

Information on payroll tax

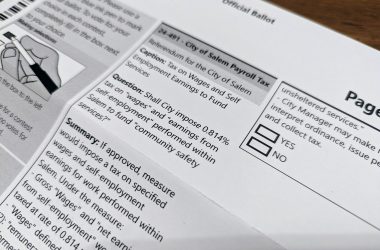

Salem city councilors are considering taxing Salem workers an average of $42 per month to balance the city’s budget without asking voters to weigh in.

Councilors will discuss for the first time Monday, June 12 an ordinance to impose a tax to add police and firefighter positions and sustain services for unsheltered Salemites. At a later meeting, the council will vote on whether to implement the tax or send it to voters for approval.

The first reading of the ordinance is planned for June 26, and a public hearing on the matter will be held either then or on July 10.

Improvements on Northeast Center Street

Marion County is planning to build a new turn lane, bike lane and sidewalk on Northeast Center Street using federal funds. The project, which is in the design phase, aims to make biking and walking safer there.

The city council will consider acquiring property between Northeast Lancaster Drive to 45th Place Northeast to begin the project, about five blocks.

Though the county will complete the project, the city must authorize the easements since they are within city limits, according to a staff report from Public Works Director Brian Martin.

$50,000 wastewater grant

Councilors will consider awarding a $50,000 wastewater pretreatment grant to Oregon Fruit Products, which makes fruit purees and canned fruit for retail, beer and cider. The business has been in Salem since 1935, and is located on Southeast 22nd Street.

The company installed a water-cooling device, a $300,000 project, in February. The investment will reduce the amount of heated water it releases into the wastewater system by an estimated 5.8 million gallons each year.

The amount of water used for pasteurization has dropped from 485,000 gallons a month to around 1,000, according to a report from Martin, and added three jobs through increased production.

In the report, Martin said the city received a grant application from the company in December 2021. The project reduces the chance the Willow Lake treatment facility will reach its maximum daily temperature load.

Carl Haynes, facility manager, requested the $50,000 grant from the city for the investment in seeing the project through, according to an undated letter.

Federal grant for community service officers

The city will consider accepting grants from the U.S. Department of Justice, which it has used in past years to maintain the Salem Police Department’s Community Service Officer Program. Those officers work in patrol and take on calls such as directing traffic at crash scenes, non-injury accidents, inactive burglaries, stolen cars and noise complaints, according to a staff report from police Chief Trevor Womack.

If approved, the city would execute agreements from fiscal year 2021, which total $81,523 for the city, and $11,099 for Marion County. According to the application, the city has eight part-time community service officers.

$100,000 in county funds for the airport

The city will consider an agreement with Marion County to receive a $100,000 contribution to its $1.9 terminal renovation project at the Salem Municipal Airport. If approved, the city will get the funds in two payments, according to a staff report from Martin.

The renovation, expected to be completed this month, includes upgrades to windows, walls and flooring, plus new outdoor canopies and updated bathrooms.

Buying a house

Councilors will consider an agreement with Raymond and Diane Cooper to purchase and demolish their home at 2530 Mountain View Drive S. for $560,000.

The home is prone to flooding, and the Public Works Department wants to demolish the house to build drainage improvements and expand the stormwater sewer system for the neighborhood, according to a staff report from Kristin Retherford, director of community and urban development.

The city will also hold a public hearing on a plan to annex 4.21 acres in the 4800 block of Southeast Macleay Road. The property owner, Chris Weddle, submitted an application in order to receive city services according to a staff report.

SUPPORT OUR WORK – We depend on subscribers for resources to report on Salem with care and depth, fairness and accuracy. Subscribe today to get our daily newsletters and more. Click I want to subscribe!

Abbey McDonald joined the Salem Reporter in 2022. She previously worked as the business reporter at The Astorian, where she covered labor issues, health care and social services. A University of Oregon grad, she has also reported for the Malheur Enterprise, The News-Review and Willamette Week.