Salem city councilors are considering taxing Salem workers an average of $42 per month to balance the city’s budget without asking voters to weigh in.

Councilors will discuss for the first time Monday, June 12 an ordinance to impose a tax to add police and firefighter positions and sustain services for unsheltered Salemites. At a later meeting, the council will vote on whether to implement the tax or send it to voters for approval.

The draft ordinance was written using feedback from a May 10 budget committee meeting, where members split on the issue of whether to recommend the council ask voters to approve a tax. The budget committee, which includes all eight city councilors, Mayor Chris Hoy and nine appointed volunteers, voted 13-5 to recommend the council adopt the tax without a citizen vote.

Committee members in favor at the time said that the funding was necessary to keep city services running, whether voters liked it or not. They also said the time required to get the issue on the ballot would delay the city getting needed revenue.

“What happens if it’s no and the need doesn’t change? The issue doesn’t change. So, you know, we’re right back there,where we started holding a bunch of really hard decisions that just got a heck of a lot harder to make,” said Councilor Virginia Stapleton, budget committee chair, who represents central Salem.

Those opposed said that it was too much to impose on families struggling to make ends meet without asking.

“There are people deciding whether to eat, pay the rent, put gas in the car and I want voters to help us make this decision,” said Councilor Jose Gonzalez, who represents northeast Salem.

The council will review and discuss the draft ordinance during its June 12 meeting, and will not take action on it at that time. The first reading of the ordinance is planned for June 26, and a public hearing on the matter will be held either then or on July 10.

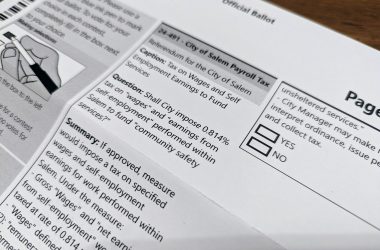

The proposed payroll tax is a rate of 0.814% of wages earned above minimum wage, which is currently $13.50 per hour in Marion County. That rate is above the highest amount proposed in the draft city budget, and was increased so low-wage workers could be exempted.

The average worker in Salem makes $29.90 an hour, according to an April staff report from Salem Chief Financial Officer Josh Eggleston. Using the city’s payroll tax calculator, that comes out to a tax of $42.19 per month or $506.24 per year.

It would draw from the paychecks of people who work in Salem, including commuters and remote workers employed by Salem-based businesses or government entities, according to a city website. People who are self-employed would also be taxed.

The amount of wages taxed will depend on the amount of time an employee works within Salem city limits, strategic initiatives manager Courtney Knox Busch said. For example, a hybrid employee who’s in a Salem office two days per week and works from a home outside Salem three days per week would pay taxes on 40% of their pay.

If councilors approve the tax as written, it would be effective as early as July 1, 2024. The city would have to take the tax to voters no later than July 1, 2031. If voters disapprove then, the tax would end in December 2031.

In a staff report, Eggleston estimates the tax would generate $27.9 million annually, enough to hire a dozen police officers, staff a newly built fire station and keep the door open at the city’s new navigation center.

The navigation center, a $15.5 million shelter where 75 people who are homeless can access tools to stabilize their housing, mental health and employment, will welcome its first guest this month. The center does not have funding secured to remain open beyond 2025.

In May, City Manager Keith Stahley told Salem Reporter that a payroll tax was selected because it would meet the revenue need for the city, and would not require going to the voters every five years like a levy would. The tax also broadens who is getting taxed beyond property owners, by including people who work in Salem but live outside city limits.

The budget committee first suggested a payroll tax in 2018. It was planned for a vote in April 2020, but the council pulled it from the ballot when the Covid pandemic hit.

The city faces a budget deficit of $19.4 million by 2028. Eggleston points to Measures 5 and 50, which capped property tax revenue growth at 3% per year in the 1990s, as the major source of revenue issues. Those measures mean the cost of providing government services due to wage increases and inflation rise faster than the amount of property tax the city can collect, he said.

Without the payroll tax, funding to the navigation center and micro shelters would likely be the first cuts, Stahley told Salem Reporter in May.

During the May budget committee meeting, Mayor Chris Hoy and councilors Virginia Stapleton, Linda Nishioka, Trevor Phillips and Micki Varney voted in favor of recommending the city council impose a tax without voter approval. They were joined by budget committee members Russell Allen, Stacey Vieyra-Braendle, Andrew Cohen, Paul Tigan, Bill Dixon, Julie Curtis, Roz Shirack and Dr. Irvin Brown.

“I understand that there may be frustration of a reluctance to have voters consider this, but getting this kind of information to voters in time to solve the structural deficits that we face as a result of the broken taxation system here in the State of Oregon would take time that we just don’t have,” said Phillips, who represents southeast Salem.

Four councilors voted against recommending the council unilaterally tax Salem workers: Deanna Gwyn, Julie Hoy, Jose Gonzalez and Vanessa Nordyke, joined by committee member Derik Milton.

“The city’s on a cliff, but a lot of families are on a cliff too. The people that I have been talking to are saying ‘We support police, we support fire, but you need to come to us,’” said Gwyn.

During the meeting, Chris Hoy said he was unsure of how he would vote on the tax when it came to the council.

“I am torn, because I was the person who made the motion to defer the payroll tax to the voters last time. I wasn’t willing to impose it. I still don’t know that I am,” he said, but that he would support it during the budget committee meeting. “From strictly a budgetary perspective, we have to support this motion. There is no other option.”

Contact reporter Abbey McDonald: [email protected] or 503-704-0355.

SUBSCRIBE TO GET SALEM NEWS – We report on your community with care and depth, fairness and accuracy. Get local news that matters to you. Subscribe today to get our daily newsletters and more. Click I want to subscribe!

Abbey McDonald joined the Salem Reporter in 2022. She previously worked as the business reporter at The Astorian, where she covered labor issues, health care and social services. A University of Oregon grad, she has also reported for the Malheur Enterprise, The News-Review and Willamette Week.