The campaign to put Salem’s recently approved payroll tax to a public vote has submitted more than 10,000 signatures to the city over a week before the deadline to put the measure on the ballot.

Let Salem Vote!, the Political Action Committee leading the effort, announced the milestone in a Tuesday afternoon news release. Salem-based business group Oregon Business & Industry, which is the primary funder of the campaign, set a goal of 6,000 signatures.

The groups will continue to collect signatures until the final deadline to submit on Aug. 9.

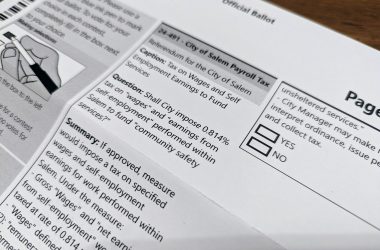

The Salem City Council narrowly approved a tax on wages for anyone working within city limits in a 5-4 vote after a lengthy meeting on July 10. The tax is intended to help close a city budget shortfall and would pay for additional police and firefighters, as well as funding operations for several homeless shelters after federal money for the programs runs out.

A June 12 report from the city estimated the tax would bring in $27.9 million per year. Workers would pay 0.814% of wages, about $42 per month for a Salem worker earning the city’s average wage of $29.90 an hour. Minimum wage earners are exempt.

To go onto the ballot, the petition requires that 3,986 verified signatures are submitted by Aug. 9. If it does not meet the qualification by the deadline, the council’s decision would put the tax to a public vote no later than 2031, after seven years of tax collection.

Now that the petitioners have submitted signatures, the city recorder will verify that enough have been collected before sending them to Marion County elections for verification, according to a July 24 city report. Those who signed must be registered to vote in the city of Salem to qualify.

Marion County Clerk Bill Burgess said Tuesday afternoon it wasn’t immediately clear whether the county would be able to verify signatures in time to put the measure on the November ballot.

If county workers verify signatures after the Aug. 9 deadline, the issue would be on the May 2024 ballot, according to the city report.

In the release, Let Salem Vote! said that it expects more invalid signatures than usual due to confusion over eligibility.

“There is understandably a lot of confusion about who can sign the petition due in large part to the complexities of the tax itself,” said Oregon Business & Industry president Angela Wilhelms in the release. “For example, a lot of voters have a Salem address but do not live within the technical city limits. So, even if those folks work within the city and are subject to the tax, their signature would be invalid.”

The submitted signatures will be reviewed by Salem’s city recorder, who will file it with the Marion County Elections Division if it meets the minimum required valid signatures.

“Our focus is on letting the process play out,” said city spokeswoman Courtney Knox Busch in a Tuesday email to Salem Reporter.

The payroll referendum campaign has received over $46,000 in cash and in-kind contributions, chiefly from the political action committee for Oregon Business & Industry, and the group itself, which have contributed a total of about $32,000. Other top donors are Salem law firm Sherman Sherman Johnnie & Hoyt, with $5,573 in-kind, and conservative political consulting firm Intistar Strategies, with $3,572 in-kind.

If the issue goes to the ballot, the election costs are estimated to be around $220,000, largely covered by the city according to the July city staff report.

Councilors who voted in favor of implementing the tax before a public vote have said that bringing the issue to the public would take considerable time and effort from the city’s elected leadership.

“Having just run the bond campaign, I believe the prospects of raising that amount of money and finding councilors willing to spend the time necessary to run a campaign would be virtually impossible,” Mayor Chris Hoy said to Salem Reporter in a July 16 email. He was referring to the November 2022 campaign for a city bond to fund infrastructure projects, which local voters overwhelmingly approved. Hoy did not immediately respond to a call for comment Tuesday afternoon.

It’s not the first time that, facing budget issues, the city has faced a petition challenging their proposed solution. A decade ago, the city put together a task force which recommended charging for downtown street parking. The council opted not to move forward with the plan after a downtown property owner petitioned for a ballot measure banning parking meters, gathering 6,000 signatures, according to the Statesman Journal.

Correction: A previous version of this story stated that the counties would be responsible for election costs. Since the election is in an odd numbered year, the city would cover the costs. Salem Reporter apologizes for the error.

Managing Editor Rachel Alexander contributed reporting.

Contact reporter Abbey McDonald: [email protected] or 503-704-0355.

SUPPORT OUR WORK – We depend on subscribers for resources to report on Salem with care and depth, fairness and accuracy. Subscribe today to get our daily newsletters and more. Click I want to subscribe!

Abbey McDonald joined the Salem Reporter in 2022. She previously worked as the business reporter at The Astorian, where she covered labor issues, health care and social services. A University of Oregon grad, she has also reported for the Malheur Enterprise, The News-Review and Willamette Week.