Nearly 12,000 Oregonians who have been making payments on their federal student loans for at least 20 years will soon find their balances wiped out.

The U.S. Department of Education notified qualifying borrowers July 14 that by Aug. 14 they should have no remaining balance. The agency will clear nearly $573 million currently owed by 11,780 Oregon borrowers, for an average of nearly $48,000 each.

They are among tens of thousands of Oregonians with nearly $21 billion in outstanding student debt. About 85,000 are behind on payments, according to the Oregon Department of Justice. When the pause on repayments is lifted in October, they’ll have to start paying again.

The average borrower in Oregon owes $36,000 by the time they graduate.

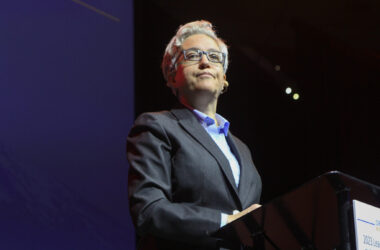

Attorney General Ellen Rosenblum, who is hosting a symposium this week in Portland on the student debt crisis, welcomed the federal action but said more needs to be done.

“We owe it to our young people and to those who have worked so hard for so long, relying on their education to help them get ahead, not to bring them down,” she said.

She said in a statement that officials, advocates and students must work together to ensure that student debts don’t become a lifetime obligation.

Get more information

Anybody with questions about student loans, or scams, should go to studentaid.gov, especially for more information on the restart of payments.

You can also contact Oregon’s ombudsperson on student loans, Lane Thompson, at 888-877-4894 (toll-free).

The loans being forgiven are income-driven, meaning their payment plan sets a borrower’s monthly payment at an amount intended to be affordable given the borrower’s income. Under the plan, as long as borrowers make 200 to 300 monthly payments, or about 20 to 25 years of regular payments, their balances are supposed to be wiped out. But for years the federal agency undercounted payments by failing to keep track of all of them, and failed to properly transfer payment histories between loan servicers, causing low-income borrowers to continue to pay down balances that should have been forgiven. By 2021, only 32 of the 4 million people who had been making income-driven payments for the last 20 years had received the debt relief they were promised, according to a report from the National Consumer Law Center.

In 2022, the agency conducted a review and made adjustments to reflect accurate payments made over the last 25 years.

“Inaccurate payment counts have resulted in borrowers losing hard-earned progress toward loan forgiveness,” a news release from the agency said.

Nearly 12,000 Oregonians who have been making payments on their federal student loans for at least 20 years will soon find their balances wiped out.

The U.S. Department of Education notified qualifying borrowers July 14 that by Aug. 14 they should have no remaining balance. The agency will clear nearly $573 million currently owed by 11,780 Oregon borrowers, for an average of nearly $48,000 each.

They are among tens of thousands of Oregonians with nearly $21 billion in outstanding student debt. About 85,000 are behind on payments, according to the Oregon Department of Justice. When the pause on repayments is lifted in October, they’ll have to start paying again.

The average borrower in Oregon owes $36,000 by the time they graduate.

Attorney General Ellen Rosenblum, who is hosting a symposium this week in Portland on the student debt crisis, welcomed the federal action but said more needs to be done.

“We owe it to our young people and to those who have worked so hard for so long, relying on their education to help them get ahead, not to bring them down,” she said.

She said in a statement that officials, advocates and students must work together to ensure that student debts don’t become a lifetime obligation.

The income-driven repayment plan for federal student loans sets a borrower’s monthly payment at an amount intended to be affordable given the borrower’s income. Under the plan, as long as borrowers make 200 to 300 monthly payments, or about 20 to 25 years of regular payments, their balances are supposed to be wiped out.

But for years the federal agency undercounted payments by failing to keep track of all of them, and failed to properly transfer payment histories between loan servicers, causing low-income borrowers to continue to pay down balances that should have been forgiven. By 2021, only 32 of the 4 million people who had been making income-driven payments for the last 20 years had received the debt relief they were promised, according to a report from the National Consumer Law Center.

In 2022, the agency conducted a review and made adjustments to reflect accurate payments made over the last 25 years.

“Inaccurate payment counts have resulted in borrowers losing hard-earned progress toward loan forgiveness,” a news release from the agency said.

While people under the age of 30 are most likely to have student debt currently, about half of all student debt owed is held by adults between 30 and 45 years old, according to the nonprofit Education Data Initiative.

Nationwide, the federal education agency will discharge $39 billion in debt held by 800,000 borrowers who should have previously had their remaining loan balances forgiven under the income-driven repayment plan.

Attorneys general across the country, including Rosenblum, have worked to protect borrowers. Over the past decade, they have worked to shut down predatory lenders. A recent national settlement with Navient Corporation, one of the largest student loan servicers, resulted in 5,488 Oregonian federal loan borrowers receiving $1.4 million in restitution, with 864 Oregon borrowers receiving private loan debt cancellation.

In Oregon, Rosenblum spearheaded a law in 2017 requiring all Oregon colleges and universities to send students annual, easy-to-understand letters explaining the scope of their federal education debt. In 2021, she initiated a “Student Loan Borrowers Bill of Rights” to address many of the problems borrowers experience with companies that service their student loans.

She warned borrowers to pay attention to letters or messages from servicers and to requests to resign online accounts. She said students with debt are a potential target of scammers.

“Be wary of contacts ‘out of the blue’ – do not provide personal information or payments of any kind until you have ascertained they are in fact your new loan servicer,” Rosenblum said.

While people under the age of 30 are most likely to have student debt currently, about half of all student debt owed is held by adults between 30 and 45 years old, according to the nonprofit Education Data Initiative.

Nationwide, the federal education agency will discharge $39 billion in debt held by 800,000 borrowers who should have previously had their remaining loan balances forgiven under the income-driven repayment plan.

Attorneys general across the country, including Rosenblum, have worked to protect borrowers. Over the past decade, they have worked to shut down predatory lenders. A recent national settlement with Navient Corporation, one of the largest student loan servicers, resulted in 5,488 Oregonian federal loan borrowers receiving $1.4 million in restitution, with 864 Oregon borrowers receiving private loan debt cancellation.

In Oregon, Rosenblum spearheaded a law in 2017 requiring all Oregon colleges and universities to send students annual, easy-to-understand letters explaining the scope of their federal education debt. In 2021, she initiated a “Student Loan Borrowers Bill of Rights” to address many of the problems borrowers experience with companies that service their student loans.

She warned borrowers to pay attention to letters or messages from servicers and to requests to resign online accounts. She said students with debt are a potential target of scammers.

“Be wary of contacts ‘out of the blue’ – do not provide personal information or payments of any kind until you have ascertained they are in fact your new loan servicer,” Rosenblum said.

Oregon Capital Chronicle is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Oregon Capital Chronicle maintains editorial independence. Contact Editor Lynne Terry for questions: [email protected]. Follow Oregon Capital Chronicle on Facebook and Twitter.

STORY TIP OR IDEA? Send an email to Salem Reporter’s news team: [email protected].

Alex Baumhardt has been a national radio producer focusing on education for American Public Media since 2017. She has reported from the Arctic to the Antarctic for national and international media, and from Minnesota and Oregon for The Washington Post. She previously worked in Iceland and Qatar and was a Fulbright scholar in Spain where she earned a master's degree in digital media. She's been a kayaking guide in Alaska, farmed on four continents and worked the night shift at several bakeries to support her reporting along the way.