Economic recovery and recession – these are the phrases of the moment. And the question of the moment is: will the area’s almost complete economic recovery from pandemic job losses be followed by a recession?

We say “almost complete” recovery because several industries are still not back to pre-pandemic job levels. And the possibility of a recession occurring is on a lot of minds lately, because the governors of the Federal Reserve Board, the nation’s central bank, are concerned that inflation is too high. They’re getting ready for more interest rate hikes to try to choke it off.

So, let’s take a closer look at the area’s economy and how it has recovered. Then we’ll discuss inflation and what the chances are of a recession down the road.

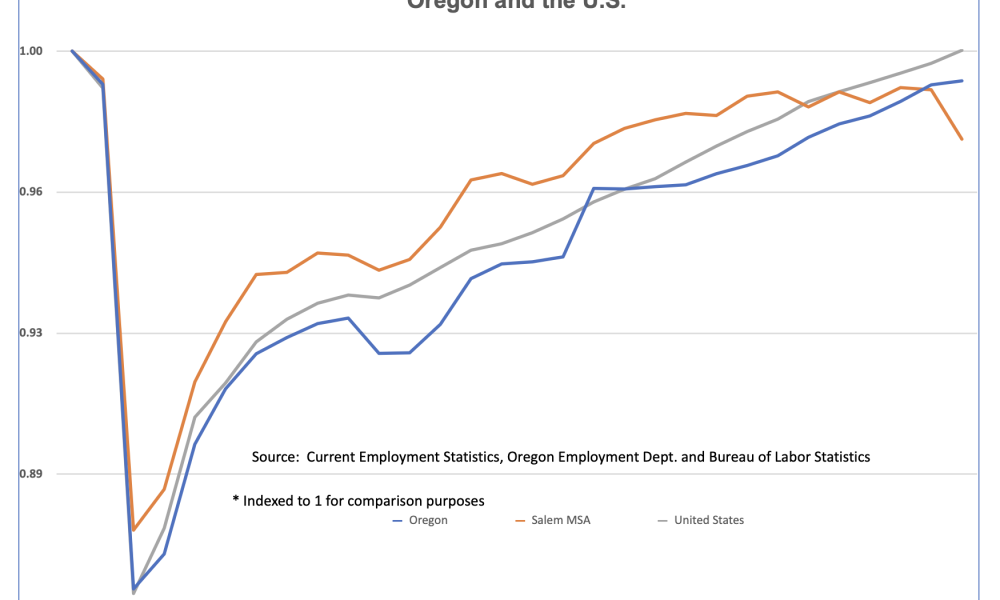

Keep in mind that the economy has recovered from catastrophic job loss just two and a half years ago. The Salem area, Oregon and the U.S. fell off a cliff in April of 2020 in terms of job loss. An almost unbelievable thirteen or so percent of all jobs disappeared in one month (see graph). A good portion of these were low-wage jobs in the leisure and hospitality industry, where half the jobs disappeared in the first months of the pandemic. Many of the workers in this industry eventually took jobs in other industries. What happened to these workers is described in an Oregon Employment Department study that helps explain why the industry is still short of workers.

After the initial huge job loss, Salem, Oregon and the U.S. regained substantial numbers of jobs quickly. Nearly three and a half percent of the jobs returned in May of 2020, and another two and two-thirds percent in June. This is unprecedented. A normal month-to-month gain in jobs is less than 1%.

So where are we now in terms of recovery? There’s a lot of good news. The Salem area has recovered 98% of its jobs, Oregon 94%, and the U.S. 100%. However, official estimates show the Salem area losing jobs over the last two months. Pat O’Connor, the Oregon Employment Department economist for the area, says the decline could be the result of the monthly volatility that can occur due to the small sample size used to do the monthly estimate (only several hundred out of nearly 14,000 businesses). These declines may be revised upward over the next few months when more data is available, says O’Connor.

The industries affected the most early on by the pandemic shut downs were leisure and hospitality, health care and social assistance, and local government education (K-12 schools). These three industries are still not back to pre-pandemic job levels – here’s where they stand as of July 2022:

- Salem area leisure and hospitality industry jobs are still down 9% and Oregon 6%

- Salem health care industry jobs are down 1%, and Oregon 2%

- Salem local government education jobs are down 5%, and Oregon 6%

Unemployment is as low as it’s ever been, 3.5%. In fact, the economy is likely at full employment. In other words, everyone who is capable of working and wants a job has one. Those who were unemployed (8,707 people in July in the Salem area) are likely new entrants into the labor force, are maybe young with fewer job skills. The unemployment rate for those aged 18-19 was 12% in July, and for those with less than a high school diploma, 8.3%. It may take these folks a bit longer to find a job, but they surely will in the current economic environment.

In the tightest labor market in decades where employers are competing for workers, you’d expect wages to be increasing. They are, particularly in lower wage (and harder to hire for) jobs. However, wage increases haven’t kept up with inflation. Although inflation has flattened somewhat over the month of July, mostly because the price of gas fell, it’s still too high in many economists’ opinions – around eight and a half percent or so. That’s a big number considering it’s been between one and a half and three percent for the last several decades.

The classic definition of inflation is too much demand chasing too few goods, causing prices to rise – there’s no disagreement about this. What economists have been disagreeing about is what’s causing excessive demand. Some of the causes mentioned include wage increases, the generous federal aid to families and businesses during the pandemic, and pent-up demand for vacations, visits to restaurants, and other leisure time activities.

The “too few goods” has a number of possible explanations as well. These include supply chain issues, some due to lack of ability to hire those who move goods such as truck drivers for example; product manufacturers cutting back on production during the pandemic, and now having to ramp back up again; and the ongoing Covid lock-downs in China, a major source of consumer goods.

And last but not least, a number of economists mention another possible cause of higher prices: price-gouging by companies taking advantage of increased demand by simply charging inflated prices.

Whatever the causes, it seems that there will be more interest rate hikes. Even though inflation was somewhat flat in July for the first time in months, the Federal Reserve Board chair has said that one month of good news isn’t enough to slow down its schedule of rate hikes.

The reason that economists worry that further interest rate hikes could bring on a recession is that the track record of the Federal Reserve Board on this issue isn’t a good one. A too-common occurrence after the Board raises interest rates to combat inflation has been recession. And once, in the early ‘80s, the tradeoff was extreme – interest rate hikes to fight 12% inflation resulted in 12% unemployment.

The Oregon Office of Economic Analysis economists, in the latest state revenue forecast, weighed in on the chances of a recession. They say the risks are “uncomfortably high.” However, in order to do the forecast, they assumed that, for now, inflation will slow and further interest rate increases may not be needed.

The nation gained 315,000 jobs in August, a hefty increase, and labor force participation grew some. Both are good news, but is it good enough for the Federal Reserve to slow its plans for more interest rate hikes? Only time will tell.

Pam Ferrara of the Willamette Workforce Partnership continues a regular column examining local economic issues. She may be contacted at [email protected].

STORY TIP OR IDEA? Send an email to Salem Reporter’s news team: [email protected].

JUST THE FACTS, FOR SALEM – We report on your community with care and depth, fairness and accuracy. Get local news that matters to you. Subscribe to Salem Reporter starting at $5 a month. Click I want to subscribe!

Pamela Ferrara is a part-time research associate with the Willamette Workforce Partnership, the area’s local workforce board. Ferrara has worked in research at the Oregon Employment Department, earned a Master’s in Labor Economics, and speaks fluent Spanish.