Inflation in the U.S.

Inflation in the U.S.

Over the course of the pandemic, the Salem area’s economy has experienced the largest job loss in a single month, 21,000 jobs from March to April of 2020, and the fastest recovery ever from a recession.

The unemployment rate took 14 months to fall from its high of 11.6% in April 2020 to 5.2% in July of 2021. In the recession of 2008, it took seven years for the unemployment rate to fall to 5%.

And yes, the economy was officially in recession for the months of March and April of 2020, which is another first – the shortest recession ever.

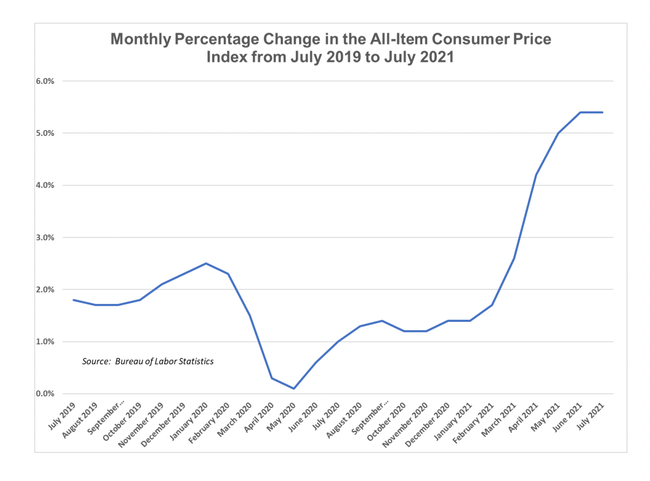

Now we’re seeing not exactly a first but something we haven’t seen in a while, rising inflation. The U.S. is experiencing the highest rate of inflation in more than a decade. If it persists, it will have implications for many areas of the economy, both locally and nationally.

But first, some definitions.

Inflation is, simply put, rising prices. The federal Bureau of Labor Statistics, part of the U.S. Department of Labor, tracks prices each month of a typical market basket of goods and services in communities around the U.S.

Month-to-month price changes are measured against a base year set to 100 – currently the base year is 1982. This information is used to construct the Consumer Price Index. Changes in the Index are expressed as a percentage, and commonly called inflation. The Bureau has been measuring inflation this way since 1921.

The market basket is modified every so often to account for new products and services, and over the decades, its makeup has changed dramatically. For example, in 1950, one-third of the market basket was food items, and another 13% clothing. Both together now make up only 18% of the market basket.

Inflation has been low in most years of the post-WWII economy, ranging between 2 and 4%. One exception was the period of the late 1970s and early 1980s when inflation was nearly 14%.

How it happened goes something like this.

Government spending on the Vietnam War and the war on poverty heated up the economy in the 1960s. Then came rising oil prices and oil shortages in the 1970s. All this resulted in double-digit inflation in 1979.

The Federal Reserve Board, the central banking system of the U.S., has a mandate to control inflation and so in 1980 raised interest rates to combat it. Inflation came down, but causing a recession and unemployment rates in double digits.

Average wages in Salem have remained behind both Oregon and the U.S. average.

Average wages in Salem have remained behind both Oregon and the U.S. average.

Why is a high rate of inflation worrisome? Because it affects the buying power of wages, among other things. During the high inflation of the late 1970s and early 1980s, wages didn’t keep up with inflation. (See graph)

Overall, wages have been doing pretty well since then. The steep rise in 2020 is likely due to the loss of so many low-wage jobs during the pandemic, which skews average wages higher.

If you want to know whether your paycheck has kept up with inflation, use the following inflation calculator to find out.

Many important items are indexed to inflation, and two of them have a large impact on the economy, the Oregon minimum wage, and Social Security benefits.

The state minimum wage has been indexed to inflation since 2002 when Oregonians approved a ballot measure to do so. About 5% of earners work at minimum wage in the Salem area, and a slightly larger percentage in the state as a whole.

But when the minimum wage increases, as it did this July, it has a ripple effect on wages at higher levels as employers feel the need to raise wages to remain competitive. So, the economic impact is greater than just the increase.

Social Security beneficiaries, by law, receive a cost-of-living adjustment annually to account for inflation, commonly known as a COLA. It’s a big deal because Social Security pays out nearly a trillion dollars a year to its beneficiaries.

Social Security has paid automatic COLAs since 1984.The COLA is computed by comparing inflation in the third quarter of the year (July, August and September) to inflation in the third quarter of the year before, and the difference is used as the increase. Recipients may receive their largest COLA in over a decade in January of 2022. If this happens, a debate on how to calculate COLAs may return.

At least two alternatives have been discussed.

Some policy makers advocate a “chained” Consumer Price Index for measuring COLAs. A chained index accounts for people substituting the purchase of cheaper items for items with large price increases. A chained index would produce lower inflation rates and smaller COLAs.

Some groups advocate for a different market basket of items to be used in Social Security COLAS, as the elderly spend a much larger percentage of their income on medical care, a high-priced item. In 1965, the Bureau of Labor Statistics created an index to take this into account (it is called the Consumer Price Index for Americans aged 62 and older). Social Security COLAs would be larger under this index, but it has not been used.

So, what is the current inflation rate, why is it happening and is it likely to persist?

Since April, the monthly change in the Consumer Price Index has climbed steadily, and in July was above 5%. (see graph) These are the largest increases since 2008. Increased demand for goods and services, (as the pandemic seemed to be waning and more of us were out spending money), and problems with supply, are typical explanations.

The governors of the Federal Reserve Board and many economists are predicting that this higher inflation is transitory, and will likely come down to lower levels once the pandemic economy sorts itself out. Only time will tell if their prediction is correct, or if fighting inflation is to become, once again, a headline in our economic story.

Pam Ferrara of the Willamette Workforce Partnership continues a regular column examining local economic issues. She may be contacted at [email protected]

JUST THE FACTS, FOR SALEM – We report on your community with care and depth, fairness and accuracy. Get local news that matters to you. Subscribe to Salem Reporter starting at $5 a month. Click I want to subscribe!