Employment in the Salem Metropolitan Statistical Area has stayed close to trends in Oregon and the U.S. (Pam Ferrara)

Employment in the Salem Metropolitan Statistical Area has stayed close to trends in Oregon and the U.S. (Pam Ferrara)

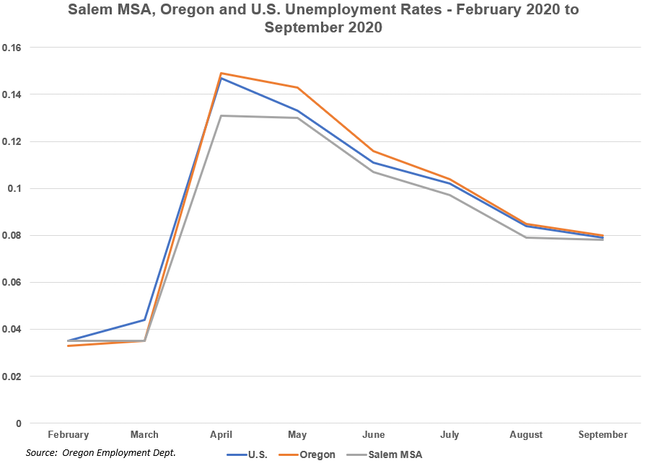

Salem’s unemployment rate declined in September to 7.8%, closely tracking Oregon and U.S. unemployment rates (see graph).

These rates track closely because the mix of industries locally is similar to that on the state and national level. States still experiencing double-digit unemployment rates have an unusual industry mix. For example, Hawaii, where tourism is king, and California, capital of the movie and television industries, travel and entertainment have been hard hit by the policy efforts to contain Covid.

Although Salem and the state have similar mixes of industry, Salem has seen bigger job losses. As of September 2020, employment dropped by 10% (17,800 jobs) in the Salem area compared to the same time last year. Statewide, the drop for the same time period was 6% (130,000 jobs). Let’s examine employment in Salem area industries over the months of the pandemic, see where Salem’s trends are different from the state’s and try to explain the differences.

Government is Salem’s largest industry, with state and local government comprising nearly a quarter of all jobs.

State government employment has been stable over the last seven months. According to state economic analysts, tax collections (that pay for everything in state government including state workers) are holding up well and will likely do so into the next budget cycle. That are at least two reasons behind this.

The first is that higher-income workers who pay a lot of taxes have not suffered the job losses experienced by lower-wage workers who don’t pay as much. Lower-wage workers have borne the brunt of the pandemic-related business shutdown.

A second reason is federal and state aid to workers and businesses over the last months (more on this later in the column). It is possible that state government employment will be affected eventually, according to state economic analysts, but that situation could be a few years away.

School employment, part of local government, is a different story. It’s down 23% in Salem and 14% in Oregon.

Josh Lehner of the Oregon Office of Economic Analysis offers an explanation in his Oct. 19 blog on why schools are using far fewer substitute teachers than they normally would. Lehner explains “with online school, teachers feeling under the weather can better manage a few live meetings with their classes or send additional work remotely, whereas standing in front of the room all day is more challenging.”

There’s also a possible technical explanation for Salem’s large drop. July, August and September employment is estimated by federal Labor Department economists from a sample of 342 of the Salem area’s 13,000 businesses. “Estimating from such a small sample has been made even more challenging by the uniqueness of this economic downturn,” says Pat O’Connor, Oregon Employment Department economist for the Salem area. Therefore, the small sample size may not fully capture what is going on.

The sample for the entire state is much larger at 2,420 businesses, making it more reliable.

Clarity is coming, however. All Oregon businesses report their employment and payroll every quarter to the Oregon Employment Department. When this information is available a few months from now employment numbers for the third quarter of 2020 will be solid.

Other Salem industries have recovered normal job levels to varying degrees:

- Retail trade, 11% of employment, reached normal levels in September, both in Oregon and in Salem.

- Healthcare and social assistance, 17% of employment, is down 9% and only 2% in the state as a whole. The small sample size may be the reason for the disparity.

- Construction, 8% of employment, is recovered from a year ago. The $600 million school construction levy passed by area voters in May is a factor.

- Professional and business services (lawyers, computer engineers, accountants, and the like), 8% of employment, is down by 16% and only 6% in the state. Salem’s small sample size may also be to blame for the disparity;

- Staffing agency employment, classified as part of professional and business services, is down only 2% versus 8% in the state. Salem’s healthy construction industry may be helping to boost employment in this sector.

- Food manufacturing is down 26%, undoubtedly affected by last year’s NORPAC closure.

- Leisure and hospitality is still struggling with huge job losses. It’s down 34% in the Salem area and 24% in the state.

The contribution of state and federal aid dollars to the economy has been significant. These programs injected $5.2 billion dollars into the pockets of the unemployed, self-employed and business owners in Oregon from mid-March through mid-October. Salem’s share is estimated to be $383 million. It’s likely that Salem’s economy would have been in worse shape without the aid.

Here’s what we can conclude:

- There are still some big holes in local government, as well as health care and social assistance jobs, possibly the result of estimating recent employment numbers from a small sample.

- Construction and staffing employment are doing well, and state government employment is stable for now.

- Leisure and Hospitality industry employment, paying the lowest wages of any of Salem’s industries, is still down about a third of what it would normally be. It likely won’t recover fully until pandemic case numbers decrease and the activities this industry represents can function normally again.

One additional note: The October unemployment rate for the U.S. was just published, at 6.9 percent, one point lower than September. Watch for the Oregon and Salem rates, which will be published later this month, to see if they continue to track the U.S. rate.

Pam Ferrara of the Willamette Workforce Partnership continues a regular column examining local economic issues. She may be contacted at [email protected]